The Best Article You’ll Read on Cash Flow

Jun 10, 2021 by Roger Scherping

I spent a couple of hours reading quite a few articles on the Internet about cash flow. There were titles like, “How to Manage Cash Flow,” “Cash Management Tips to Grow Your Business,” and “What is Cash Flow and How Do I Manage It?” I thought I’d save you the trouble of reading them all and summarize for you what I learned.

“Cash is King”

The first thing I learned is that “Cash is King.” I think every article contained that over-used phrase. Of course, that lack of creative expression doesn’t make this old axiom any less true. The other thought that nearly every article contained was, “Cash is the lifeblood of your business.” Again, this is as true as it is overused. If your cash is not flowing (i.e., positive cash flow), then your business could come to a screeching halt. Miss a payroll just once and see what I mean.

I read many different definitions of just what cash flow is. The simplest one was the best: Cash flow is the difference between cash in and cash out for a given period of time. I like that. In the past I have asked people about their cash flow situation, and they would simply pull out their phone, log into their bank account, and show me their cash balance. That’s not what I mean. I mean, what is your cash flow situation? Yes, that is your balance today, but what I really want to know is what is going to happen in the next six months. Do you expect to have more cash than today? How low will your cash balance get during the next six months? Will you run out of cash at some point during that time?

Day-to-Day Cash Management

Your cash won’t manage itself. You don’t expect your sales team to manage itself, do you? Or the people running your warehouse? Yet most small companies I have seen have no process for managing their cash. They deposit the checks in the bank, make sure they have enough cash for payroll, and then they simply pay bills with whatever is left.

Lack of attention to something so important contributes to the 50% failure rate for businesses in their first five years.

Effective day-to-day cash management starts with having accurate, up-to-date accounting information. Get all of your customer invoices in the system, and all of your vendor bills, too. Download your cash transactions from the bank into your accounting software so that your bank balance is accurate. Have a good estimate of what the upcoming payroll will require. Cash flow is largely a data exercise, so having inaccurate accounting information will make the rest of this process difficult, if not impossible.

You all know what a balance sheet and income statement are, but how many of you have ever seen a Statement of Cash Flows (SCF)? It is probably the most important but absolutely the most overlooked of the four standard financial statements.

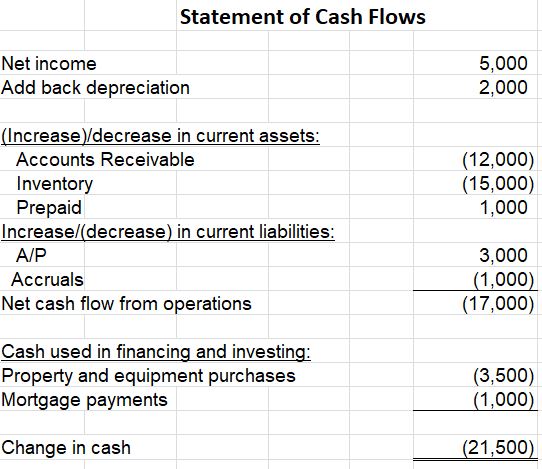

Very simply, the SCF explains in detail the difference between what your profit was and what your net cash flow was. But wait, you ask, what’s the difference? Many business people fail to realize there can be a significant difference between profit and cash flow. In fact, it is easy to describe a situation where a profitable company might have a negative cash flow. Here is an example.

This company was profitable, but it had a significant negative cash flow! The SCR very clearly shows us why: They had a large increase in accounts receivable and inventory, probably because they are growing. This increase in accounts receivable and inventory used up $27,000 in cash! In addition, they bought some equipment and made debt payments. So remember: profit is not the same as cash flow!

One of my favorite quotes comes from a client who, after we reviewed his financial statements and discussed cash flow, said to me, “You know, there were lots of years when I made tons of money, but I was broke.”

So pay more attention to your cash flow than you do to profit. Both are important, but cash flow deserves more of your attention. Understand your SCF. Know what is driving your cash flow. Are you growing and investing a lot of cash in growing accounts receivable and inventory? Does your projected cash flow suggest that you can make a significant investment in inventory, equipment or new personnel? Do you have short-term need for more cash?

When I was leading turnarounds of troubled companies, I easily spent 50% of my time analyzing, planning, and managing cash. You would do well to spend enough time on cash management that you know what your key cash drivers are and can anticipate where the potential problems lie in the future.

Cash Management Tactics

If you do see problems ahead, then the quicker you realize that and the quicker you react, the better off you will be. A banker told me once, “You can’t call me on Thursday night and say, um, I can’t make payroll tomorrow.” That is too late for them to help you.

The articles I read suggest many great tactics for improving your cash flow. Here are a few:

Understand your cash breakeven point. How much cash do you have to bring in every month just to cover your bills? This will vary by month, of course, but look at how much you typically pay in rent, payroll, materials, etc. That total is the amount you need to collect from your customers every month. Make that number a goal.

Reduce your fixed expenses. For every $1 that you spend in fixed costs like rent, you will probably need to generate $4-$5 in sales. That is because it is only the gross margin on those sales that is available to cover your fixed costs. So one powerful way to get to positive cash flow quickly is to reduce your fixed costs. Always try to spend only on essentials.

Accelerate collections from customers. Everyone hates calling their customers about past due bills, but that is literally the fastest way to increase cash flow. I have seen instances where a company hesitated to call their customer about a bill that had gone unpaid long past the 30-day terms. Eventually they did call, and the customer said they had never received the bill and asked for a copy so that they could pay it immediately. So here the company waited 90 days to get paid, and it was completely unnecessary! Make a habit of calling all of your customers promptly about past due bills. There’s even nothing wrong with calling them a few days before the bill is due just to see if there is any problem and ask whether you can expect payment in a few days.

Make it easy to pay you. Most business payments are still made by check, which adds a few days to your collection process due to mailing time. Make it easy for your customers to pay you! QuickBooks allows you to put a “pay by credit card” button on your invoice, and there are other digital payment options, like PayPal. You can even set it up with your customers that you initiate payment from their bank account on the due date via an ACH debit.

Maintain a cash reserve. Set aside an emergency fund so that you have it in case you come up short for payroll or a vendor is insisting on an immediate payment. These are situations that could cause your business to shut down, so if they happen you will be happy you have a little extra cash on hand.

Do a rolling 4-week cash projection. Create a spreadsheet showing what your expected cash receipts will be by customer over the next four weeks and the amounts that you expect to pay for payroll, rent, materials, etc. for the same period. This look-ahead is the best way to anticipate problems and take quick action to avoid a catastrophe.

More ideas. Other things you can do to improve your cash flow:

- Do a better job of managing the credit you offer your customers. Quickly cut off those customers that are slow-pay or no-pay.

- Offer early payment discounts to your good customers.

- Slow your payments to your vendors if doing so does not damage your relationship with them.

- Get rid of the high interest rate credit card balances that too many small businesses carry to manage their cash flow and replace them with a small, less expensive operating line of credit from a bank.

Long-Term Cash Flow Strategies

None of the articles I read distinguished between short-term cash management tactics and the longer-term business improvements that will make your cash flow better.

When I talk about cash flow, I’m really talking about what is called your cash cycle. Your cash cycle is the period of time between when your salesperson comes in the door with a big smile holding the large purchase order he just got from a customer, until the day the controller deposits that customer’s check in the bank.

How long is your cash cycle? Some companies get paid immediately (ecommerce), some take 30 days (common), and some construction companies don’t even collect their final retention amounts on a job for six months or more. Whatever your cash cycle is, figure out how you can shorten it. That is ultimately what cash flow management is about.

How quickly does the customer order get entered into your system? How quickly does the team get started on the order? The longer it takes to get the process started on a customer order the longer it will take you to get paid.

How quickly do you complete your customer orders? Can you improve your scheduling or increase your staffing so that you can complete the job two weeks earlier? That would give you the ability to send your customer an invoice two weeks earlier and get paid faster.

How well do you manage inventory? Is it as low as it can be? A just-in-time approach to inventory means not ordering until you actually need the product. In this way you will not be paying for inventory before your customer has paid you, so you will not be in a temporary negative cash flow situation on an order.

How do your terms with your customers compare to your terms with your vendors? Do you give your customers better terms than you get? Perhaps you can get a deposit from your customer to cover your upfront costs and keep you cash flow positive on their order. Also, many very large companies have used the leverage of their size to extract extended terms from their vendors, sometimes as long as 90-120 days! If your vendors are only giving you 30-day terms, then you will be in a negative cash flow situation until you finally get paid by your customer. Consider accounts receivable factoring as a way to align your accounts receivable with your accounts payable.

How quickly do you send out invoices to your customers? Do you save them up and send them at the end of the month? If you do, you are literally adding days to your cash cycle for every day you wait. You should be billing your customers daily!

How quickly does the customer’s payment get to your bank? Do you deposit checks daily? Most banks allow you to deposit checks electronically, so it should be easy to do daily deposits. Even better, get your customers to pay you electronically so that the money goes immediately into your bank account with little or no wait for the payment to clear.

No More Cash Flow Worries

Shortening your cash cycle is accomplished by making structural changes in how your business operates. Tighten things up! Do every aspect of your process better and faster. Once these changes become engrained, you will have a company that is wired to have positive cash flow. Then your only worry will be what you are going to do with all of your excess cash!

ProjectionSmart helps companies plan ahead, understand their numbers, and avoid problems. Let us help you see your financial future.